By Betsy Levinson — Betsy@theconcordbridge.org

The Finance Committee has voted unanimously to withdraw Town Meeting Article 25, which, if passed, would have appropriated almost $600,000 from the free cash account to the Middle School Stabilization Fund.

The fund is used to “smooth out” the jump in taxes to pay for the new middle school, according to FinCom Chair Parashar Patel.

At a recent FinCom hearing, town Chief Financial Officer Anthony Ansaldi said the balance in the Stabilization Fund is about $4.5 million. It will be used to offer property tax relief in Fiscal Year 2026.

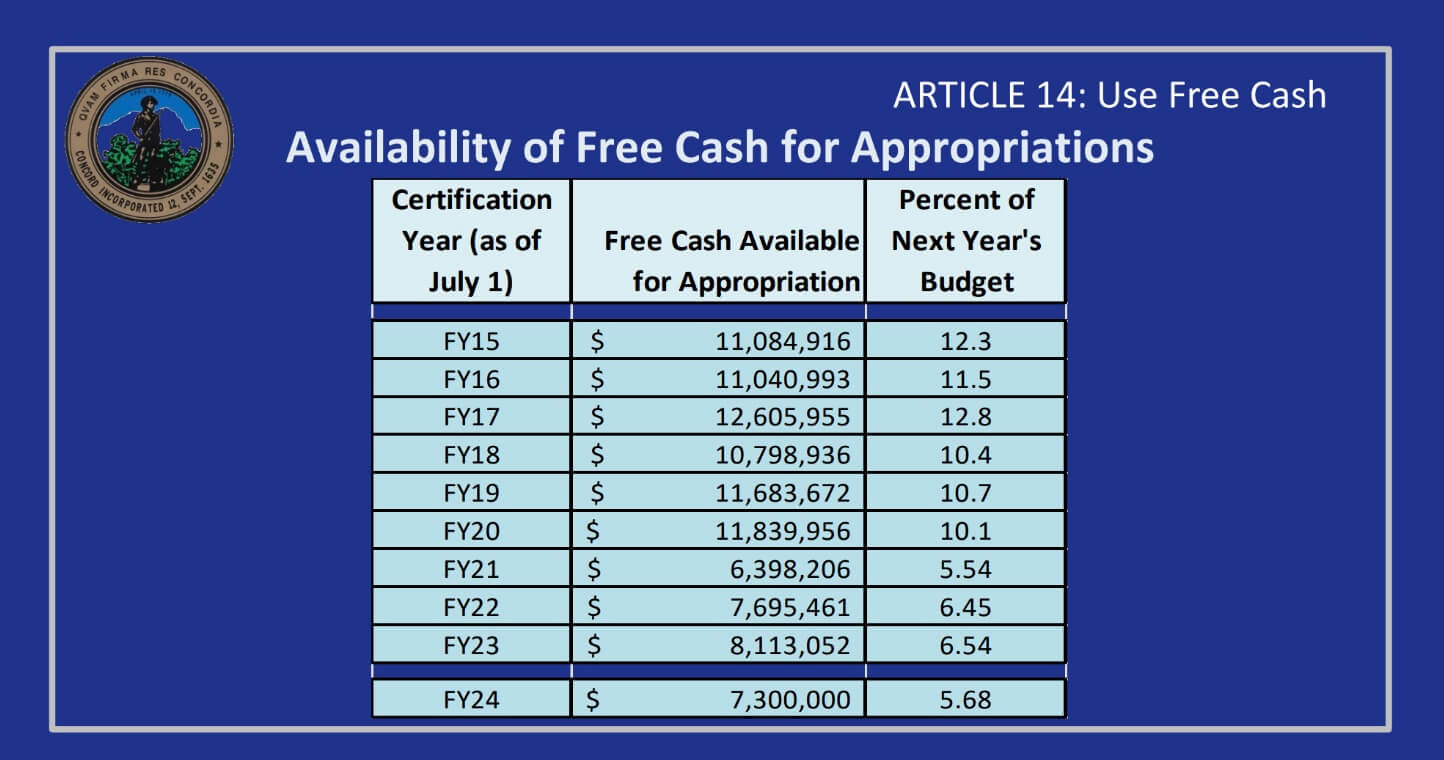

But the town’s cash reserves are low, Patel said, falling from a healthy $11,839,956, or 10% of the FY20 budget, to $6,398,206, or 5.54% for FY21. Patel said the numbers inched up to $7.3 million, or 5.68%, last year, but that’s still unsustainable.

FinCom policy stipulates free cash should be maintained at 5 to 10% of the general fund. It can be used to provide property tax relief, but “only to the extent that it can be replenished the following year.”

Article 14 in the spotlight

At the public hearing, Mary Hartman, a member of the Select Board speaking on her own behalf, cautioned against draining free cash.

Photo by Celeste Katz Marston

Her objection concerns Article 14, which seeks to transfer $1 million to the general fund for operating expenses. Patel said the FinCom is wrestling with the article and will decide at a future meeting whether to support the article, reduce the amount below $1 million, or not move it.

“The practice of taking money from free cash reserves to fund operating expenses began when we had comfortably high balances,” Hartman said in a follow-up email.

“This is no longer the case. In fact, our free cash balance is hovering at the low level of an acceptable range,” she said. “Using reserves to fund operating expenses is not a best practice.”

Hartman favors “reducing it incrementally in subsequent years down to $0.”

“It is similar to routinely using a personal safety net to pay for everyday bills,” she said.

“It’s OK if your safety net is high — not so good when it is low. I urged the FinCom to withdraw the article or at least reduce the amount. I urged them to wean us from a bad habit.”

Other pressures on free cash for FY25 include $350,000 for public safety for the 250th semiquincentennial celebration and money for affordable housing coupled with the potential $1 million for tax relief.